10 Best Employer of Record Companies in the Netherlands (2026)

The Netherlands is becoming one of Europe’s most attractive markets for global hiring. Thanks to its strong infrastructure, international mindset, and strategic location, companies can easily reach the rest of Europe while tapping into a highly skilled, multilingual talent pool.

Add strong support for innovation and digital work, and you get a hiring environment that’s smooth, stable, and well-suited for remote-first teams.

However, for companies new to the country, handling local employment laws can still be challenging. Employers must navigate strict Dutch labour regulations, mandatory social security contributions, and statutory benefits like holiday allowances and pension schemes. On top of that, expatriate tax rules such as the well-known 30% ruling can significantly affect hiring costs if not handled properly.

Read on to see our list of best Employer of Record companies in the Netherlands to find the one that fits your expansion goals best.

What are the 10 best EOR companies in the Netherlands you should know about?

Here’s a quick overview of our top picks.

1. Native Teams

Native Teams helps you hire and pay teams across 85+ countries without setting up local entities. We take care of contracts, payroll, and compliance, so you can focus on growing your business. On top of that, you get practical tools like expense tracking, absence management, and a payroll calculator, all in one simple dashboard.

Key features:

1. EOR services

With Native Teams, you can expand your workforce across 85+ countries without the complexity of establishing local entities.

We take care of compliant hiring and onboarding, while our integrated tools simplify every aspect of global workforce management.

Here are some of the possibilities with our EOR services:

- You can offer competitive local benefits to attract and retain top talent, including healthcare, insurance, and pension plans tailored to regional requirements.

- Our tax optimisation tools help you save more by using local allowances and deductions.

- Managing expenses becomes much easier with streamlined tracking, automated approvals, and real-time reporting.

- At the same time, absence management ensures employee time off is handled smoothly and in full compliance with local laws.

- Additionally, automated payroll delivers accurate, compliant, and timely payments in multiple currencies.

2. Global payroll services

Besides global payments, we handle all required contributions and employee benefits.

Our centralised payroll dashboard makes team management more efficient, allowing you to send payroll invites, update salaries, and monitor payments in one place.

One of the key features is the Multi-Currency Wallet, which enables instant transfers across multiple currencies at minimal cost, helping businesses avoid unnecessary fees and delays.

You can easily fund your wallet with a credit or debit card and enjoy complete transparency with detailed receipts for every transaction.

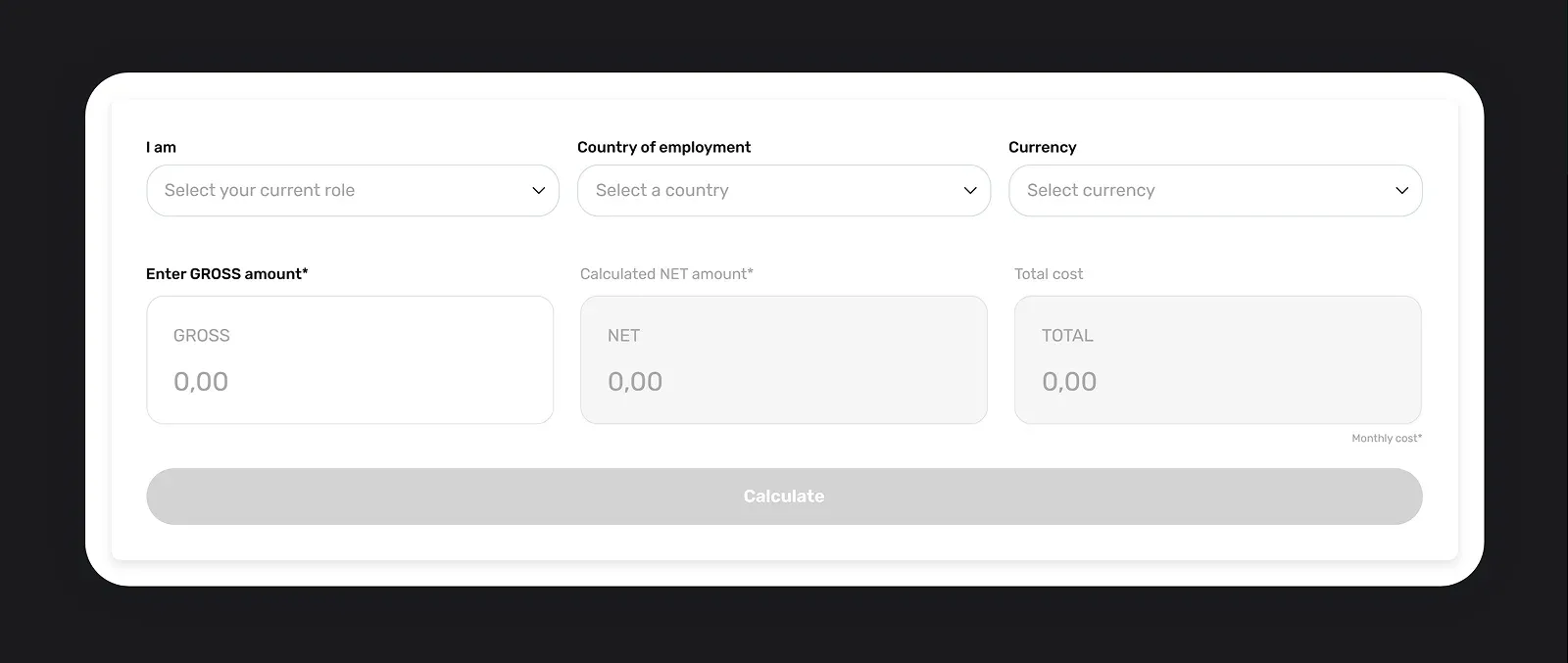

Another handy tool is the Payroll Calculator that helps you estimate salary calculations and related costs.

As a result, you get a breakdown of the expenses for hiring employees in different countries, or you can calculate your own gross and net earnings in your residential country.

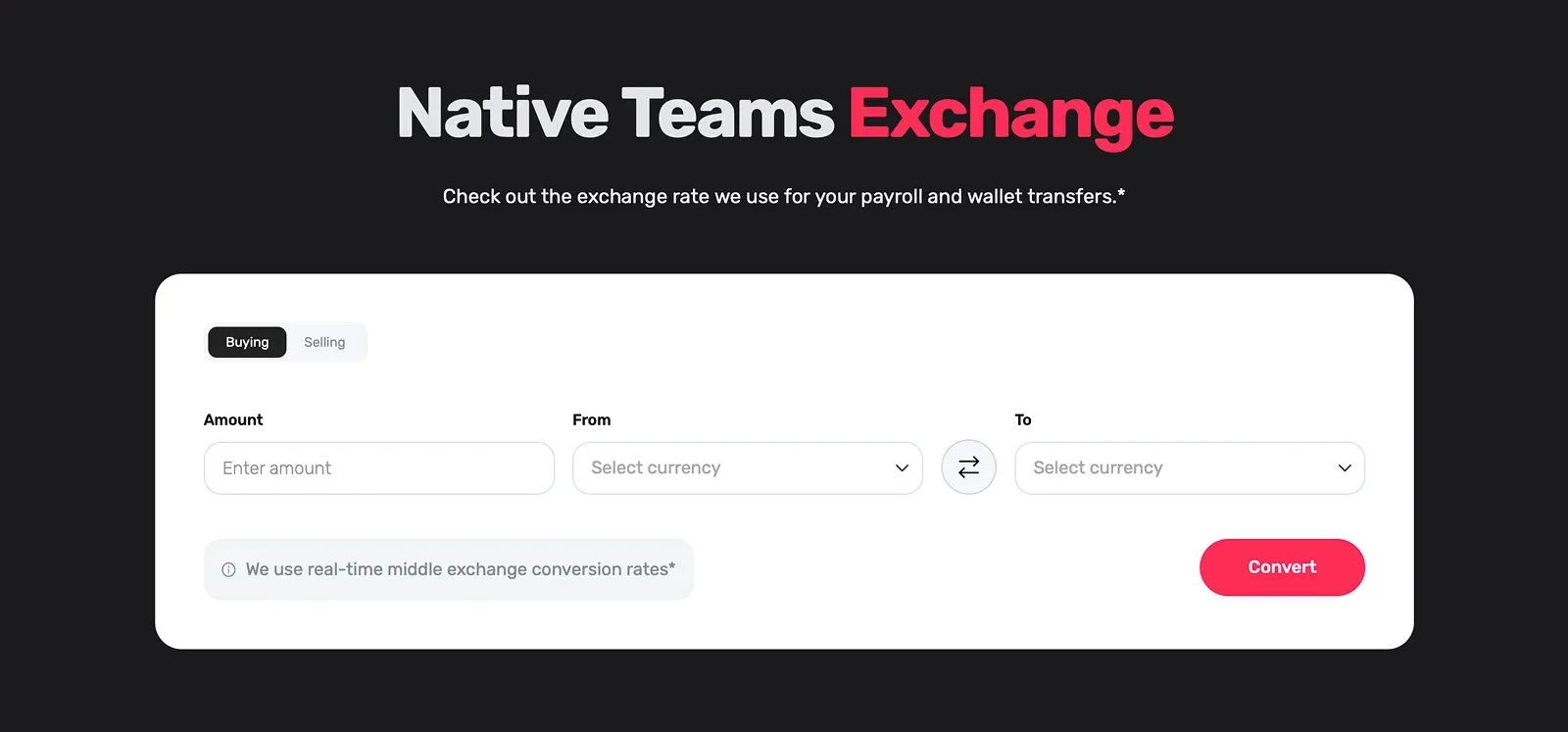

We also eliminate currency exchange guesswork. With our Exchange tool, you’ll know the exact exchange rate we use for your payroll and wallet transfers.

3. PEO services

With Native Teams’ PEO services, you maintain complete control over your team’s tasks and performance while we manage the back-office complexities.

Our experts handle wage reporting, employment tax filings, and compliance with local laws, reducing your administrative burden.

Everything is consolidated into one simple payment, making global HR management more efficient and cost-effective.

4. Visa and mobility help

Our visa and relocation assistance simplifies everything for you, from work permits and visas to legal frameworks.

We provide immigration services in over 30 countries, guiding you through the entire process with our legal experts conducting eligibility checks and submitting applications on your behalf.

You’ll also receive regular updates to stay informed at all times.

Pricing

EOR services start at $115 per employee per month with additional features and annual billing discounts, plus 1 free client/employer admin account.

2. Dutch Employer of Record

Dutch Employer of Record is an umbrella company helps you hire teams in the Netherlands without setting up your own entity.

They take care of payroll, HR, and compliance with Dutch laws, so your team is legally protected. They’re audited under the NEN-4400 standard, which means you don’t risk unexpected tax issues.

Key features:

✨ EOR services: The company takes care of all local payroll and HR requirements. It also helps with securing housing, including references for renting or buying.

✨ Compliance: Includes tax compliance and meeting UWV requirements, as well as Dutch social security coverage, pension, accident and healthcare insurance. You can also tailor contracts to stay compliant with Dutch labour law.

✨ Employer Cost Calculator: Evaluates the total cost of hiring in the Netherlands, including all taxes and contributions.

✨ Payroll services: The company manages payroll processing, employee benefits management, time and attendance tracking, employee self-service portals, reporting and compliance, and HR support.

✨ Relocating services: Help with housing, visa support, and all the necessary documents to relocate your team.

Pricing

Pricing is custom-based, and it depends on the services you need.

3. Mercans

Mercans lets you hire Dutch employees or contractors without opening a local entity. They also operate globally, but in the Netherlands their strength is payroll accuracy and compliance with local tax rules. They can even help you convert freelancers into full-time employees.

Key features:

✨ Local compliance: Ensures compliance with Dutch employment laws and regulations, and handles taxes and other mandatory filings.

✨ Payroll service: Manages local payroll and statutory benefits, and distributes payslips and salary payments.

✨ Visa sponsorship: Helps with the relocation of your international workforce, ensuring compliance with Dutch immigration and employment laws.

✨ Converting freelancers to employees: Supports the transition from independent contractors to permanent employees in the Netherlands.

✨ Employee self-service system: Employees can complete documentation, submit tax forms, choose benefits, and manage their transition via the system.

Pricing

Mercans has custom pricing, based on your company size and location where you want to operate.

4. Tarmack

Tarmack focuses on fast onboarding (under 48 hours) and helps companies stay compliant. In the Netherlands, they handle payroll, contracts, and tax filings, plus support with visas and relocations. They also offer contractor management tools if you work with freelancers.

Key features:

✨ EOR services: Provides services in more than 150 countries with tailored onboarding for each country, and legally compliant contracts and documentation.

✨ Payroll: Enables multi-currency payroll processing, including tax deductions, salary calculations, as well as employee classification.

✨ Contractor management: Provides a centralised contractor management platform for full workforce tracking. It also supports payments in over 100 currencies with customisable pay cycles and automated invoicing.

✨ Immigration services: Tarmack helps with employee relocation in over 50 countries. The service includes visa management, work permits, and permanent residency and citizenship.

✨ Recruitment capabilities: An AI-powered service to help you identify, assess, and shortlist talent by matching talent with your pre-defined requirements ( skills, budget, time zones, and others).

Pricing

Tarmack’s EOR services start at $199 per employee per month.

5. Employor

Employor is a Dutch EOR provider that’s especially useful if you’re bringing international talent into the Netherlands. They handle onboarding, payroll, and are officially recognised by the Dutch immigration authority (IND), which makes visa and work permit approvals smoother.

Key features:

✨ Work and residence permits: Recognised by the IND (Immigration and Naturalisation Service), the service includes the highly skilled migrant permit and the European blue card, besides visas and residence permits.

✨ HR services: Handle employment contracts, tax requirements and deductions, social security terms and pension accounts.

✨ PEO services: Manage salaries, tax payments, monthly salary slips and payrol administration

✨ Cost calculator: Estimates your spending, including social security costs, and net and taxable income

Pricing

EOR services have a one-off fee of $2300 and a monthly fee of $990.

6. Multiplier

Multiplier helps you hire in 150+ countries, including the Netherlands. You can onboard employees quickly with pre-set compliance flows, and they handle payments in over 100 currencies. They also offer a pay-as-you-go model if you only need to manage contractors.

Key features:

✨ Compliance: Has country-specific statutory compliance built in that handles tax filings and deductions.

✨ Automated onboarding: Offers preconfigured flows for global hiring.

✨ Automated payments: Enables ACH, SEPA, and local rails in over 100 currencies.

✨ Invoice automation: Automatically generates invoices from timesheets.

✨ Expense management: Manages and approves global expense data through one dashboard.

Pricing

EOR services start at $400 per employee per month.

7. Playroll

Playroll helps you hire and pay employees worldwide. In the Netherlands, they focus on payroll automation and compliance, making it easier to pay your team on time and stay within Dutch labour laws. They can also convert your contractors into full-time employees if you’re scaling.

Key features:

✨ EOR services: Manage payroll, benefits, and compliance, and allow integration with your existing HRIS and tools.

✨ Compliance: Helps you create compliant agreements, assess contractor misclassification, handle payroll, taxes, and reporting management.

✨ Multi-country payroll: Provides a centralized dashboard where you can link local country payroll providers for easier payroll management.

✨ Payroll automation system: Automates data validation, reconciliation, and approval workflows, with built-in variance controls and HCM software integrations.

✨ Benefits management: Enables you to create benefits packages, such as PTO and sick leave, health insurance, meal cards and vouchers, and others, to meet local needs.

Pricing

EOR services start at $399 per month per employee.

8. Velocity Global

Velocity Global offers international workforce solutions, including EOR services, global payroll management, contractor compliance, and immigration assistance.

You can hire and onboard employees in more than 185 countries while ensuring full compliance with local labour laws and regulatory requirements.

Key features:

✨ AI-driven platform: Integrates smart automation with region-specific compliance knowledge to manage payroll, taxes, and HR processes efficiently.

✨ Global payroll: Supports payments in multiple currencies, ensures accurate tax withholding, and manages statutory benefits.

✨ Immigration capabilities: Assists with international relocations by managing visa paperwork and different visa types, while staying compliant.

✨ Recruiting: Provides access to pre-vetted recruiting partners in over 100 countries.

✨ Global benefits: You can create international and localised employee benefits, such as medical, insurance and social security.

Pricing

EOR services start at $599 per month.

9. Globalization Partners (G-P)

Globalization Partners (G-P) helps companies hire in 180+ countries, including the Netherlands. They’re strong on payroll and compliance, and even offer AI tools to check contracts and documents for compliance issues. They’re a good choice if you want tech-driven support at a global scale.

Key features:

✨ Global payroll: Enables you to process payments in over 50 currencies using various methods like digital wallets, ACH (Automated Clearing House), bank transfers, wire transfers, or virtual cards.

✨ Benefits administration: You can build flexible, competitive benefits packages that meet local legal requirements and include optional perks.

✨ Smart contract creation: Allows you to automatically create country-specific, legally compliant employment contracts by providing job and professional details.

✨ HR management: Oversee the entire employee lifecycle, from recruitment and onboarding to payroll, benefits, engagement, and offboarding.

✨ G-P Gia™: An AI-powered tool, currently in Beta, that reviews documents, suggests compliance adjustments, and helps draft contracts, checklists, and more.

Pricing

G-P has custom pricing based on country, headcount, and service requirements.

10. Deel

Deel is one of the biggest names in global hiring, covering 150+ countries. In the Netherlands, they help with contracts, payroll, and compliance, and their platform includes built-in HR tools so your team can manage payslips, time off, and benefits in one place.

Key features:

✨ EOR services: Hire and onboard employees anywhere, while Deel handles contracts, payroll, and compliance with local laws.

✨ Automated payments: Supports scheduled and bulk payments for employees and contractors with multi-currency and local payment options.

✨ Compliance: Handles local tax deductions, filings, and ensures adherence to country-specific regulations.

✨ Built-In HRIS: A full-featured HRIS, centralising employee and contractor data, contracts, tax forms, and payroll records

✨ AI-powered assistance: Gives instant answers on labour laws, report generation, and workflow optimisation.

Pricing

EOR services start at $599 per employee per month.

Choosing the right Employer of Record company in the Netherlands: What should you pay attention to?

Choosing the right EOR in the Netherlands means taking into account Dutch labour laws, tax regulations, and compliance requirements, which are notably strict and complex.

Here are the key things to pay attention to:

1. Compliance expertise

When selecting an EOR, you must verify their deep understanding of Dutch regulations including statutory employer costs, mandatory pension contributions, holiday allowances, and social security obligations.

2. Employment contracts

The EOR must have expertise in managing Dutch-specific employment contracts, including probation periods, fixed-term or permanent contracts, and adherence to working hour rules and minimum wage laws.

3. Payroll and policies

Effective handling of payroll compliance is a must, including transparent payslips reflecting taxes and social security, and administration of vacation days and public holidays in line with Dutch statute.

Strong knowledge of local leave policies, such as maternity, paternity, parental, and sick leave, and the processes for lawful termination or resignations is equally important.

4. Tax management

Another critical factor is the EOR’s capability to advise on tax optimisations, taking full advantage of:

- Local allowances,

- Deductions, and

- Expatriate tax rulings, such as the 30% ruling, which can significantly affect employee taxation.

The EOR should also effectively manage employee expenses, allowances, compliance with GDPR data protection rules, and risks such as worker misclassification.

5. Onboarding, benefits, and transparent pricing

Look for an EOR that offers transparent pricing with no hidden fees, shows proof of compliance via audits, and provides a seamless onboarding experience.

It should provide legal support and dedicated customer service.

Since local benefits and statutory insurance schemes are compulsory, the provider should also help you design competitive benefits packages to attract and retain talent in the Dutch market.

For more information on Dutch-specific laws and regulations, download our hiring guide.

Why opt for Native Teams as an Employer of Record company in the Netherlands?

Native Teams offers a complete solution by combining EOR and PEO services, giving companies a reliable, fully compliant, and tech-driven platform to streamline international hiring, payroll, and HR management.

Beyond compliance, Native Teams also enhances the employee experience with access to local benefits and self-service tools.

With Native Teams, you can:

🔥 Hire in the Netherlands without a local entity, while we manage all regulatory and administrative responsibilities on your behalf.

🔥 Stay fully compliant with Dutch labor laws, ensuring employment contracts, payroll, tax filings, and benefits meet legal requirements, reducing risk and potential penalties.

🔥 Automate HR and payroll tasks in GBP through a simple, intuitive dashboard, complete with a payroll calculator for clear, accurate employee payments.

🔥 Provide competitive local benefits and allow employees easy access to contracts, payslips, and holiday management, creating a smoother HR experience.

🔥 Benefit from transparent, competitive pricing with no hidden costs.

Want to expand your team in the Netherlands effortlessly?

Book a free demo today to see how Native Teams makes expansion simple, compliant, and efficient.

Keep learning:

How EORs Protect Companies From Permanent Establishment Risk?