9 Best Employer of Record (EOR) Services in Canada (2026)

Canada’s diversified economy, strong emphasis on innovation, and integration in global trade networks provide broad opportunities for various industries.

However, the bilingual nature and provincial diversity in labour laws, social security contributions and other factors make localised compliance challenging and error-prone.

Luckily, partnering with a vetted EOR can help you handle local complexities efficiently and stay compliant.

If you’re unsure which EOR provider will be the best fit for your Canadian expansion, we provide our list of 9 employer of record companies to manage workforce operations compliantly.

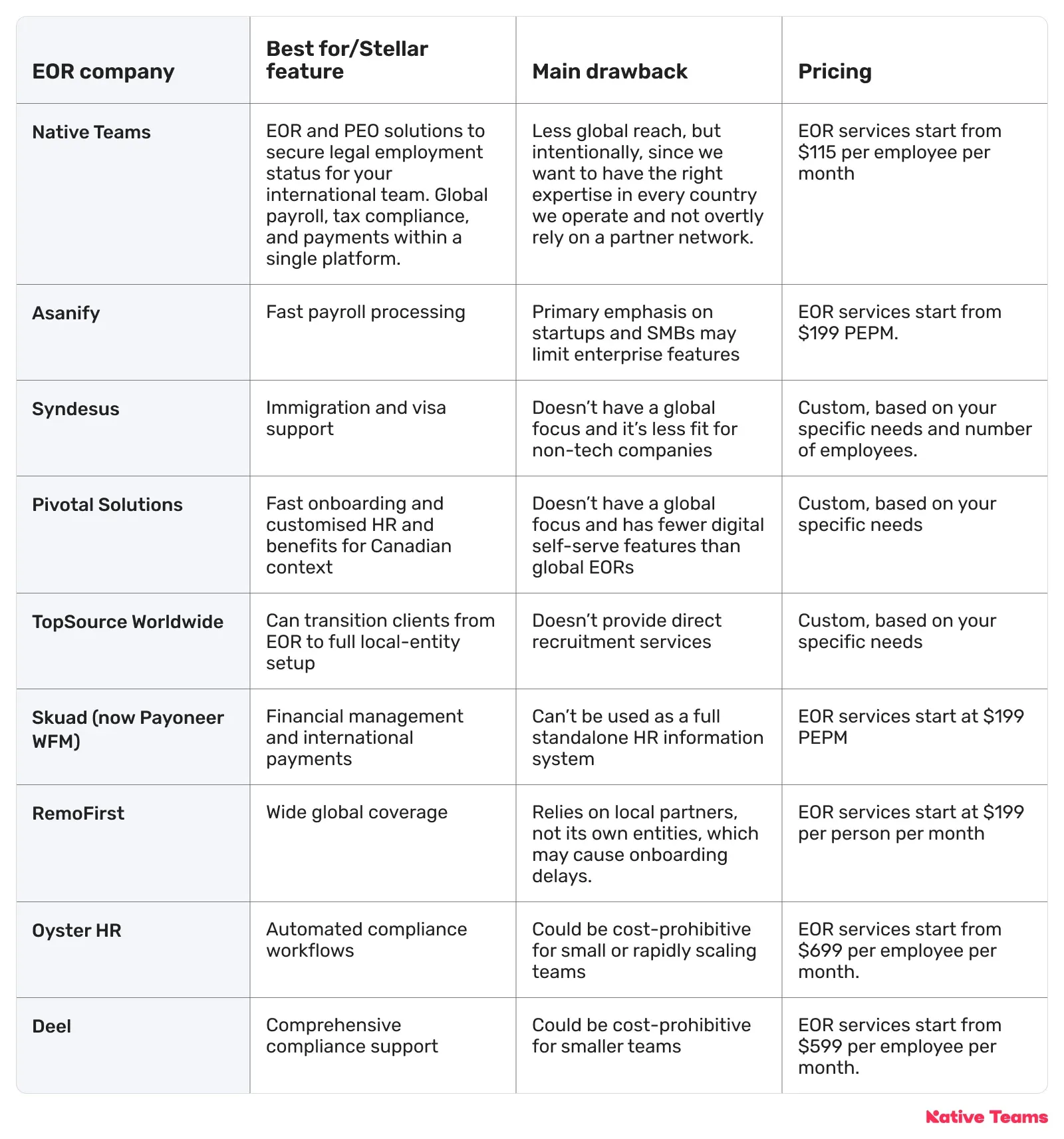

9 employer of record companies you should know about if you want to operate in Canada

Here are the highlights of our top picks.

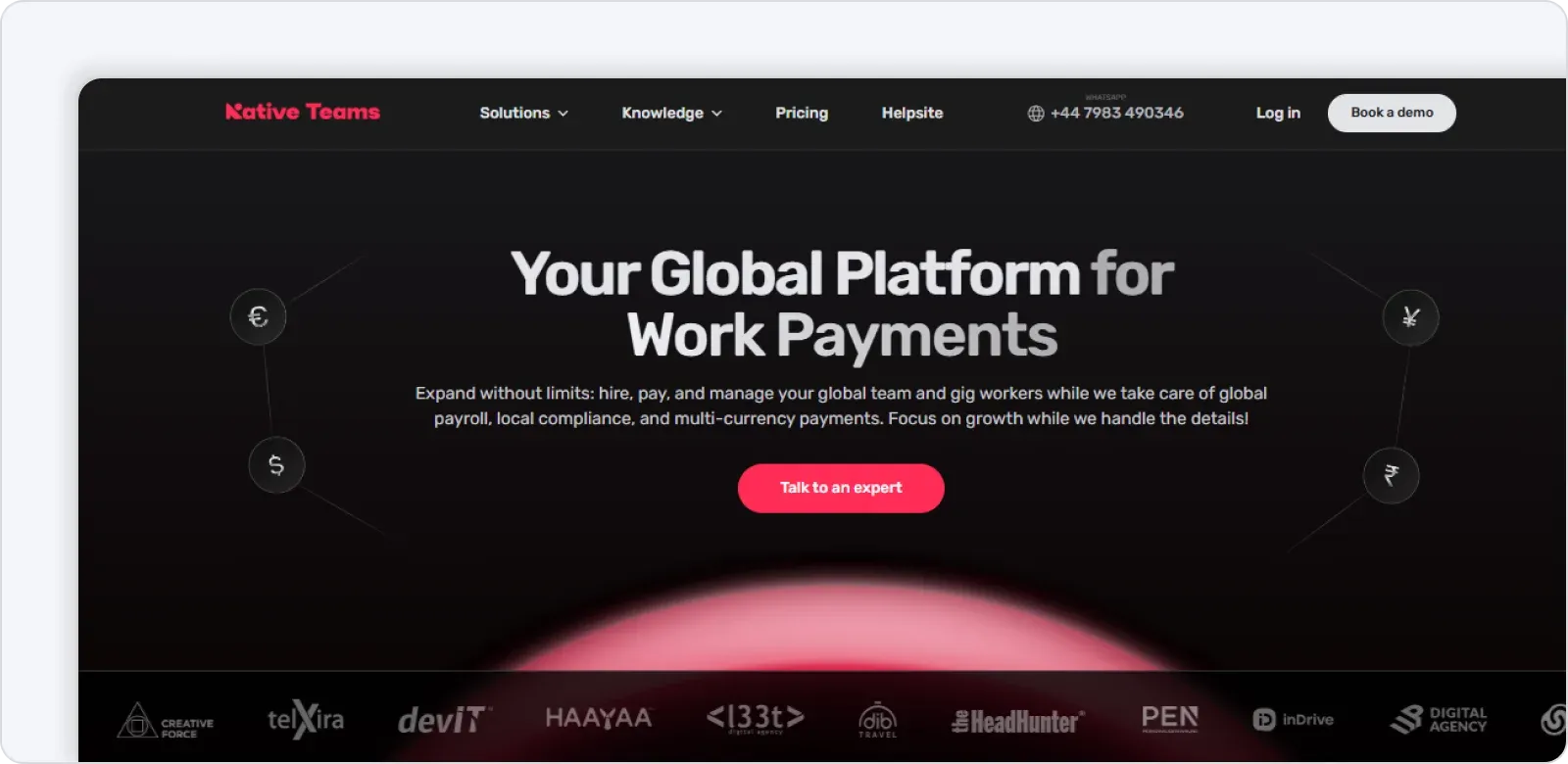

1. Native Teams

Native Teams is an EOR and PEO solution that provides a unified, all-in-one platform that streamlines every stage of managing international talent, from hiring and onboarding to payments and compliance.

Our core solutions cover:

- EOR and PEO services

- Multi-currency payments and local compliance

- Global payroll and HR management, and

- White-label solutions.

Key features:

1. EOR services

With our EOR services, you can easily hire and onboard full-time employees or contractors in over 85 countries without setting up a local entity.

We act as the legal employer, handling compliant hiring, onboarding, and day-to-day HR operations.

Our EOR solution includes:

✨ Locally competitive benefits: Attract and retain top talent with region-specific benefits packages, including healthcare, insurance, and retirement plans tailored to each market.

✨ Strategic tax optimisation: Reduce your tax burden with expert support on local allowances, deductions, and contributions, ensuring full compliance and cost efficiency.

✨ Streamlined expense management: Track and approve employee expenses effortlessly with simple upload features, automated workflows, and real-time financial reporting.

✨ Compliant leave and absence management: Handle vacation, sick leave, and other absences in line with local labor laws, built directly into your HR processes.

✨ Automated and accurate payroll: Generate precise, compliant payroll calculations with our fully integrated, country-specific payroll engine.

Native Teams ensures accurate, timely payments to your global workforce while managing all mandatory contributions, benefits, and tax obligations.

With our centralised payroll dashboard, you can easily manage your team across multiple countries and send payroll invites, adjust salaries, and monitor payments all in one place.

A standout feature is our integrated Multi-Currency Wallet, which:

- Instantly transfers funds between wallets in different currencies

- Minimises exchange fees and transaction costs

- Maximises speed and operational efficiency.

Loading your wallet is simple. You can use a credit or debit card for full transparency with receipts and real-time transaction tracking.

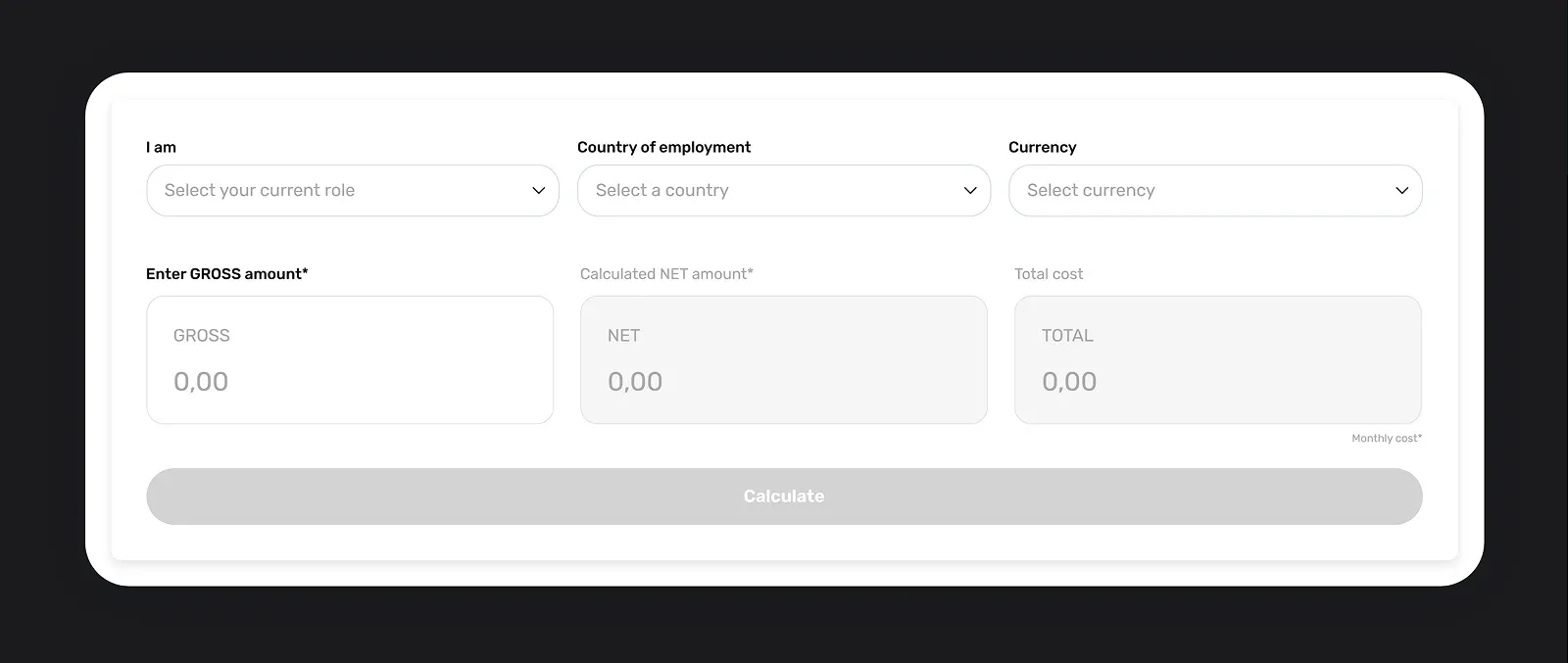

Another handy tool, a Payroll calculator, simplifies salary calculations by letting you quickly compare hiring costs internationally or estimate your own gross-to-net earnings in your home country..

This way, you can get a crystal-clear understanding of salary costs and legally required contributions in different jurisdictions, which is crucial for planning and compliance.

3. Entity management

We help you set up your own entities and provide centralised control across

all your legal entities.

You can activate payroll, compliance, and contract workflow for each country with transparent timelines, cost, and documentation tracking.

4. Employee benefits

Offer your team global benefits that align with each country’s specific labour laws, ensuring compliance.

In addition, our solution enables you to tailor benefits to your business needs. You can combine health, insurance, pension, wellness benefits, and many other benefits depending on the employee.

5. Relocation and visa assistance

With Native Teams, you can relocate employees in 30 countries while we handle everything from documentation to compliance.

Pricing

Native Teams’ EOR services cost $115 per employee month, and include 1 free client/employer admin account.

2. Asanify

Asanify is a global workforce management platform that provides integrated EOR services and HRMS capabilities for growing companies managing international teams.

Its main focus is on payroll management and HRMS.

Key features:

- EOR services: Provides support across over 88 countries for employment and over 200 for contractor management. It also has built-in regulatory updates across multiple jurisdictions.

- AI-powered chatbot: Automates routine HR tasks through Slack, Microsoft Teams, and WhatsApp.

- Payroll management: Supports payouts in 8 currencies, does fast payroll processing and automates invoicing.

- Self-service portal: Employees can manage attendance, leave, and document access.

Pricing

Asanify’s plans have a 14-day free trial, with international EOR services starting from $199 per employee per month.

3. Syndesus

Syndesus is an EOR and PEO catering primarily to tech-focused U.S. startups and firms looking to hire or relocate talent in Canada.

Syndesus provides expert help for workers and companies dealing with U.S. immigration issues, such as H-1B visa denials, OPT expirations, allowing affected talent to continue working for U.S. employers from Canada via EOR arrangements.

Key features:

- Cross-border employment: Syndesus is tailored for U.S. companies, especially VC-backed startups, to build and manage remote teams in Canada, without the need to set up a Canadian entity.

- HR & compliance: Services include payroll, legal compliance (federal and provincial Canada), benefits administration, onboarding, performance management, workplace safety, and termination support

- Relocation and retention: Employees unable to stay in the U.S. can work from Canada, with Syndesus ensuring legal employment, payroll, taxes, and healthcare coverage.

- Payroll administration: Manages employee compensation, tax and benefit deductions, remittance of statutory withholdings and employer taxes.

- Benefits administration: Management of employee benefits programs, including selecting and managing benefits plans, and enrolling employees.

Pricing

Syndesus has a one-time setup fee, plus employee fees. Pricing is custom, based on your specific needs and number of employees.

4. Pivotal Solutions

Pivotal Solutions is a Canada-focused EOR and HR outsourcing provider that supports small and mid-sized businesses entering or scaling in the Canadian market.

It specialises in Canadian labour law, payroll, and compliance.

Key features:

- HR and compliance: Manages onboarding, payroll processing (in CAD or USD), tax registration and filings, statutory benefits (CPP, EI), and compliance with both federal and provincial regulations.

- Benefits administration: Provides extensive Canadian health and dental plans, group RRSP, and other benefits.

- EOR and PEO Models: Offers both EOR (where Pivotal becomes the legal Canadian employer) and PEO (co-employment) arrangements.

- Canadian data residency: All employment and payroll data are stored on Canadian servers, complying with PIPEDA and relevant local data residency rules.

- Provincial customisation: Pivotal automatically generates and updates province-specific contracts, manages local payroll tax, and handles termination compliance.

Pricing

Pivotal Solutions offers custom pricing based on your specific needs.

5. TopSource Worldwide

TopSource Worldwide is an EOR service provider that enables hiring, paying, and managing employees in over 180 countries.

It also allows you to set up legal entities, while providing compliance, and payroll support.

Key features:

- Global employee cost calculator: Enables you to estimate the cost of your new hire by entering a country and salary information.

- Payroll: TopSource Worldwide provides global payroll and HR expertise in over 150 countries, and handles tax, benefits, and other deductions following regulatory requirements.

- Global entity management solutions: Enables you to set up entities with registration, management, reporting, sales tax, social security and more.

- ATS, an applicant tracking system: Simplifies candidate management for clients that source their talent.

Pricing:

Pricing is custom, based on your specific requirements.

6. Skuad (now Payoneer WFM)

Skuad provides solutions to streamline onboarding, payroll, invoicing, payments and other employment management aspects.

Key features:

- EOR services: You can hire and manage your workforce in more than 160 countries. Skuad provides a unified platform to manage timesheets, expenses, benefits, and more.

- Payments: Enables paying employees and contractors in 70 currencies with multiple payment methods, such as credit card, direct bank transfers, etc. It supports bulk payments, invoicing, deductions, and pay slips.

- Shield: In-house legal team provides expert guidance on employment regulations and labour laws.

- Visa and immigration services: Cover pre-visa assessment, document processing, onboarding, and visa renewals.

Pricing

EOR services start at $199 per employee per month.

7. RemoFirst

RemoFirst is a global EOR offering services in over 180 countries. It covers HR and payroll services, benefits administration, and visas and work permits.

Key features:

- Global payroll: Besides full-time employees, RemoFirst enables you to pay, manage, and onboard contractors using locally compliant contracts, and in their local currency.

- Payroll processing: Your team’s hours, time off, holidays, bonuses, and commissions are automatically calculated into payroll. You can summarise your invoices to consolidate them into one payment.

- RemoHealth: Allows you to provide personalised and international private medical insurance, and includes core, day-to-day, and specialised benefits.

- Visas and work permits: Help with visa processes and documentation in over 85 countries.

Pricing

EOR services start at $199 per employee per month.

8. Oyster HR

Oyster HR is an EOR provider operating across more than 180 countries.

It enables you to hire full-time employees and contractors internationally without the complexities of setting up local entities.

Key features:

- EOR services: Provide access to a centralised dashboard to manage team onboarding and offboarding, time off, equity and benefits, reports, and contracts.

- Global payroll: You can instantly access invoices, payslips, and reports. The system also enables you to integrate payroll workflows with your HRIS, and you can pay your team in their local currencies.

- Employee cost calculator: Allows you to estimate your employees’ total cost based on the country and gross annual salary.

- Oyster Rewards: Enables you to retain global talent by offering competitive, country-specific salary, equity, and benefits.

- Salary insights: A self-serve tool to find out the low, mid, and high salary figures for specific roles and levels based on location.

Pricing:

EOR services start from $699 per employee per month.

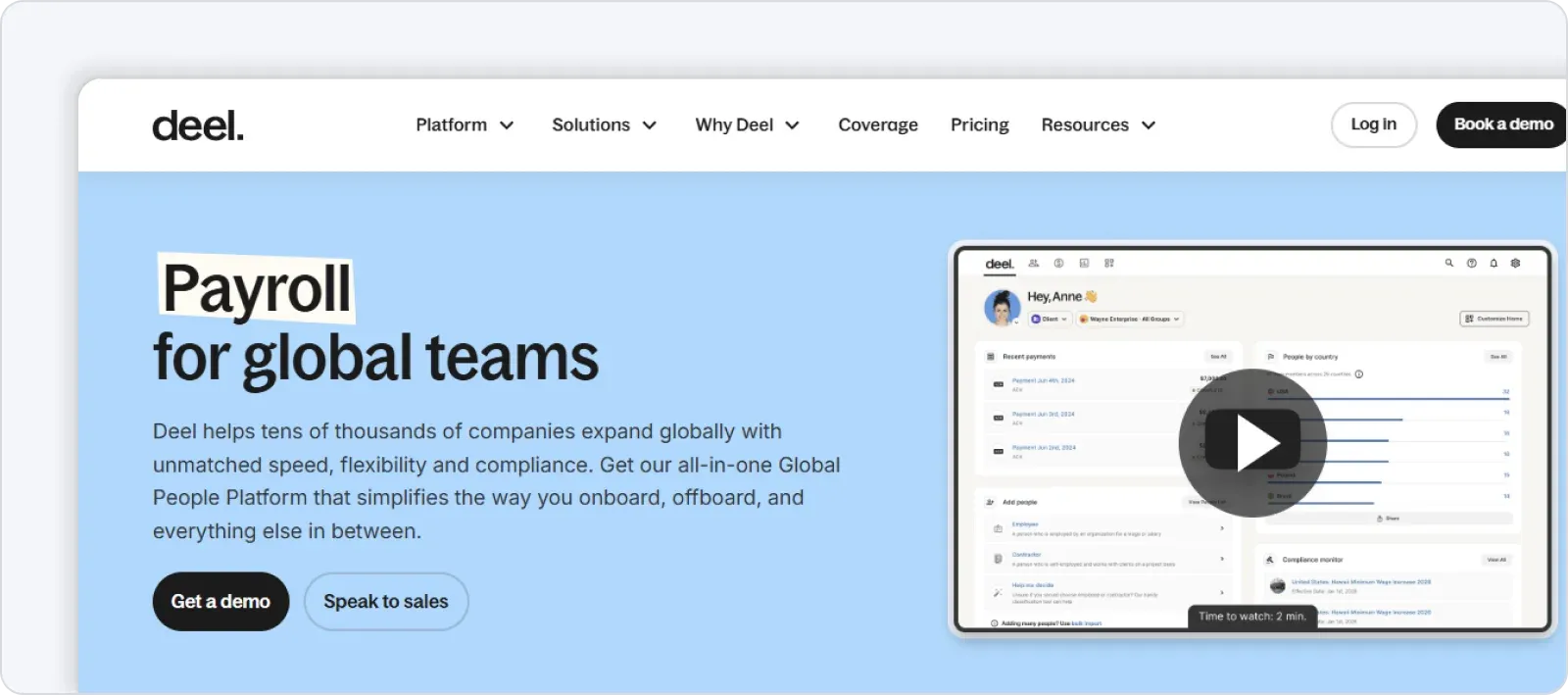

9. Deel

Deel is an EOR solution offering payroll, contractor management, and compliance solutions for distributed teams operating across over 130 countries.

The platform integrates automation, compliance, and powerful HR tools into a single system.

Key features:

- Payroll services: Deel supports over 20 flexible payment methods and payouts in over 150 currencies.

- HRIS: Provides centralised dashboards with automated workflows, smart permissions, and AI-powered reporting.

- Deel AI: Provides contextual answers across HR, payroll, onboarding, immigration, tax compliance, local labor laws, and more.

- Compliance and risk management: Supports region-specific labor laws, mandatory benefits, tax deductions, contractor classification and regulatory compliance.

- Immigration and work visas: Offers full-service visa, relocation, and sponsorship support in over 70 countries.

Pricing:

Deel’s EOR services start at $599 per employee per month.

How to choose the right employer of record company in Canada?

Before settling for an EOR provider, make sure that the company aligns with Canadian laws and regulations. Thus, check if the company:

- Registers employees with the Canada Pension Plan (CPP) and Employment Insurance (EI) programs. Contributions to these programs are mandatory and are deducted from employees’ wages, with matching contributions by the employer.

- Provides employees with a written employment contract that complies with Canadian labour laws. This document should outline key details such as job title, responsibilities, working hours, salary, benefits, and conditions for termination.

- Deducts and remits income tax, CPP contributions, and EI premiums to the Canada Revenue Agency (CRA) regularly. Failure to comply with these requirements can result in penalties and interest charges.

- Complies with provincial or territorial occupational health and safety laws.

- Offers mandatory benefits such as EI and CPP contributions, while some provinces may require additional benefits like workers' compensation coverage.

Why opt for Native Teams as your Canadian EOR?

Native Teams has its entities in each country we operate, meaning we have an in-depth knowledge of Canadian labour laws.

As a result, we provide reliable, hassle-free EOR services tailored to your needs in Canada.

We handle all administrative responsibilities, including payroll processing, employment contract preparation, onboarding, and compliance with local labour laws.

Our solutions enable you to:

- Compliantly hire, onboard, and pay your global team members.

- Easily calculate salary, taxes, benefits, and other deductions.

- Offer the perks of regular employment, like healthcare, insurance, and pensions, to attract and retain the best talent.

- Access all HR administration and documentation from a single platform.

Curious to learn more?

Book a free demo today and discover how to compliantly and seamlessly expand your business to Canada without setting up a legal entity.

Keep learning

How to Hire in the UK Using an EOR (Employer of Record)