Top 9 Enterprise Payroll Solutions [2026 Comparison List]

With a great number of employees spread across multiple countries, different currencies, and constantly changing tax regulations, managing payroll at an enterprise level is no small feat.

The right enterprise payroll solution can simplify the entire process by automating calculations, ensuring global compliance, and giving your HR team the tools they need to manage payroll efficiently and accurately.

But how to choose the right one for your organisation’s needs?

Check our top picks for enterprise payroll solutions to find the right provider for your business.

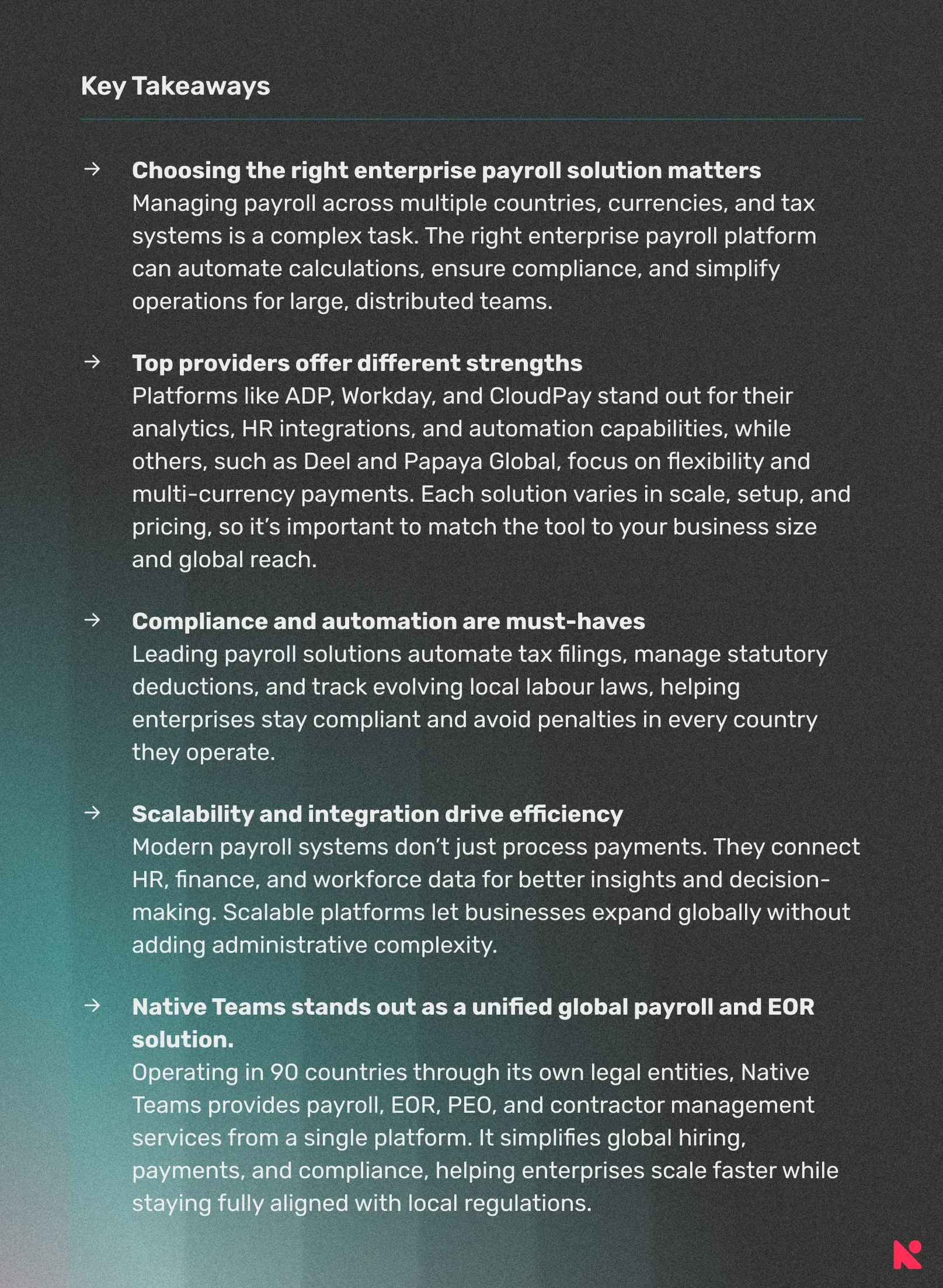

Top 9 enterprise payroll solutions to keep in mind

Here’s a preview of our top picks before we cover them in greater detail.

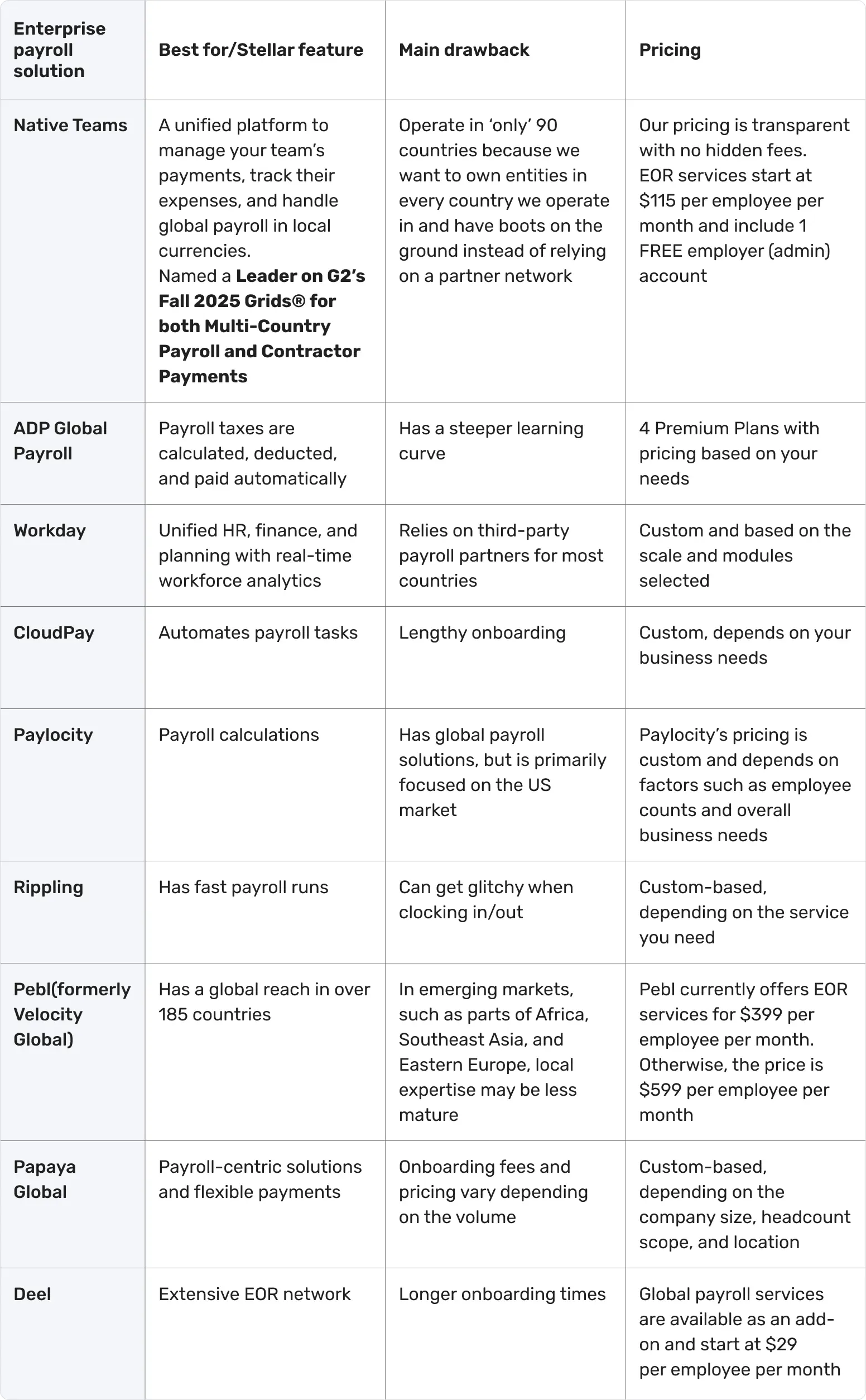

1. Native Teams

Native Teams is an all-encompassing platform that combines global payroll, Employer of Record (EOR), Professional Employer Organisation (PEO), Contractor of Record, and workforce management, all within a single platform.

Thus, you can hire, onboard, pay, and manage international employees and contractors effortlessly in 90 countries, while staying fully compliant and optimising taxes.

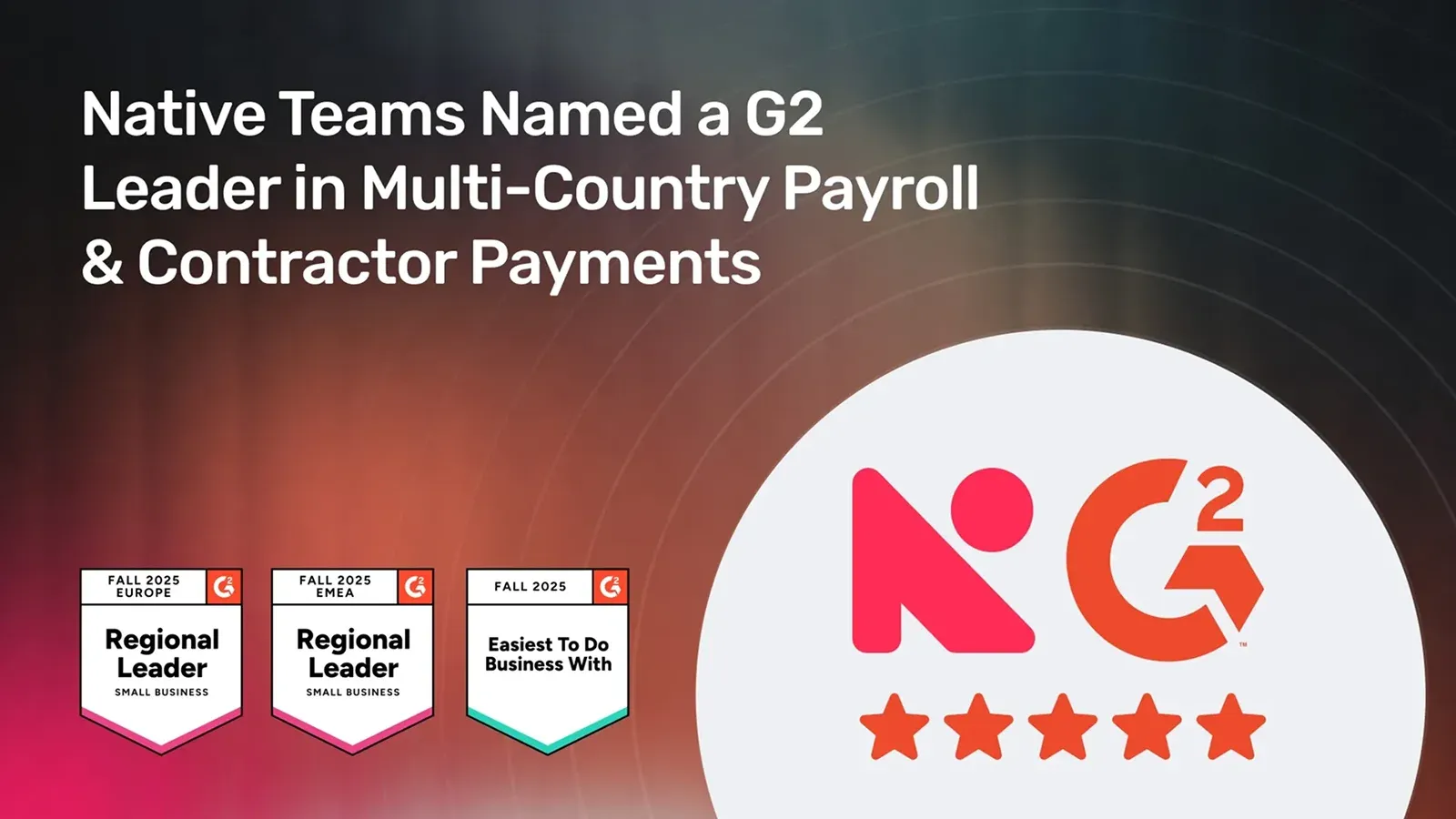

🔥 Big news: G2’s Fall 2025 Grids® recognised us as a Leader in Multi-Country Payroll and Contractor Payments.

We also earned a Customer Trust Badge, ranking in the top 20 for ‘Easiest to Do Business With’ in the global payroll category.

Key features:

1. Global payroll

Manage your international workforce with ease, no matter their employment type, while covering all necessary contributions and employee benefits.

A centralised payroll dashboard lets you send payroll invites, adjust salaries, and monitor payments, all from one place.

Here are some of the payment tools you can find on our platform:

✨ Multi-Currency Wallet: Make fast, cost-effective transfers across multiple currencies, cutting unnecessary fees and delays.

✨ Payroll Calculator: Quickly estimate salary costs and related expenses for smarter budgeting.

✨ Real-time currency management: See the exact exchange rates applied to your payroll and wallet transfers, using live mid-market rates for full transparency and accurate conversions.

2. Contractor payments

You can pay international contractors without changing your legal relationship.

Thus, you stay in control of compliance while leveraging tools to send payments fast, track expenses, and ensure a smooth experience for your contractors.

Our Contractor of Record services enable you to focus on the work while we handle the legal details, reduce misclassification risks, and make sure your contractors are paid accurately and on time.

We manage compliance, classification, contracts, and local legal obligations in your contractor’s country.

3. Entity management

You can manage multiple entities from one place by uploading your existing entity details to gain access to one platform for managing everything.

- Instantly activate payroll, compliance, and contract workflow for each country.

- Maintain a single, centralised dashboard for all your legal entities.

- Save time by cutting out manual setup and duplication.

4. EOR services

With our EOR services, you can scale your global team efficiently and compliantly, offering full legal employment in 90 countries, with no need to establish a local entity. With our own legal entities in every country we operate, we handle hiring and onboarding for employees and contractors while keeping you fully compliant with local laws.

Pricing

Our EOR services start at $115 per employee per month and include 1 FREE employer (admin) account.

2. ADP Global Payroll

ADP Global Payroll supports payroll processing in up to 140 countries, including the US states.

It provides a single platform tailored for large enterprises with complex payroll needs, focusing on advanced payroll analytics.

The platform features pre-built integrations with Human Capital Management (HCM) systems, including Oracle, SAP, and Workday.

Key features:

✨ Unified payroll management: Brings together payroll data from multiple countries, covering gross pay, deductions, and more into one centralised platform.

✨ Global compliance support: Helps you stay aligned with local payroll laws and requirements in over 140 countries.

Analytics and reporting: Provides real-time, data-driven insights for better understanding of global workforce costs.

✨ HR integration: Connect payroll with your existing HR systems through ready-to-use connectors and plug-ins available on the ADP Marketplace.

✨ Smart automation: Simplify tax processing and ensure accurate, on-time payments to authorities in full compliance with current regulations.

Pricing

ADP Global Payroll offers 4 Premium plans with pricing customised depending on your needs and company size.

3. Workday

Workday integrates HR, finance, and planning into a single system, offering real-time workforce analytics and insights.

It caters to medium to large enterprises with more advanced HR needs.

Key features:

✨ Payroll management: Automates the majority of payroll transactions with a single system for your HR, compensation, absence, time, and payroll data.

✨Global payroll: Enables payroll processing through a certified network of payroll partners in more than 180 countries.

✨ Employee self-service: Provides access to payroll slips, benefits, and compensation information, as well as related reports.

✨ Human Capital Management (HCM): You can administer and adjust plans, packages, and eligibility rules and define and manage compensation packages.

Pricing

Workday’s pricing is custom and based on scale and modules selected.

4. CloudPay

CloudPay supports enterprises with payroll in over 130 countries. It offers global payroll with local compliance features and HR integration via bi-directional APIs.

Key features:

✨ Global payroll platform: Run payroll across more than 130 countries and currencies through a single, cloud-based system.

✨ CloudPay NOW app: Give employees access to payslips, tax forms, and flexible pay-on-demand options from a mobile app.

✨ Real-time analytics & insights: Provide insights into global payroll performance with customisable dashboards and live reporting.

✨ End-to-end automation: Automates key payroll processes, including data uploads, validation, approvals, and payments.

Pricing

CloudPay’s pricing is custom, depending on your business needs, the number of employees, the countries involved, and other factors.

5. Paylocity

Paylocity unifies payroll, HR, talent management, time tracking, benefits administration, and workforce management within one platform.

Although it is primarily US–focused, it also provides global payroll solutions.

Key features:

✨ Global payroll: Helps with payroll processing across over 100 countries on one platform.

✨ In-country bank accounts: Enable in-country bank account setup with payroll funding regulations.

✨ Treasury management: Unifies international payments and settles transactions in a single currency.

✨ On-demand payment: Enables early access to earned wages.

Pricing

Paylocity’s pricing is custom. It depends on factors such as employee counts and overall business needs.

6. Rippling

Rippling streamlines payroll, HR, and IT management for companies operating across multiple countries.

It automates key processes and centralises employee data, helping organisations stay compliant with local, state, and federal regulations.

Key features:

✨ Built-in global payroll engine: Rippling operates its own native payroll system, no third-party vendors involved, to handle payroll calculations and tax filings worldwide.

✨ Automated workflows: Simplify payroll management with automation for tax processing, deductions, benefits administration, and off-cycle or retroactive pay runs.

✨ Centralised global platform: Manage payroll, benefits, time tracking, and compliance from a single system that supports operations across over 185 countries and 50 currencies.

✨ Comprehensive compliance support: Automatically manage payroll taxes and statutory benefits at national, regional, and industry levels to maintain full compliance with local regulations.

Pricing

Rippling’s pricing is quote-based, depending on the service you need, and with available add-ons that are charged separately.

7. Pebl ( formerly Velocity Global)

Pebl (formerly Velocity Global) is a global payroll and compliance solution that provides real-time payroll analytics, audit trails, and integrations with major HRIS platforms.

It caters to larger businesses or those with significant global operations.

Key features

✨ Multiple payment methods: Enable payments via ACH, wire, digital wallets, traditional banks, and crypto.

✨ Multi-currency support: The platform supports payroll in multiple currencies, allowing you to pay employees in their local currency

✨ Employee Cost Calculator: Helps you calculate payroll contributions and annual costs for your global team.

✨ Reporting and analytics: The platform offers real-time reporting and analytics on payroll metrics.

Pricing

Pebl currently offers EOR services for $399 per employee per month. Otherwise, the price is $599 per employee per month.

8. Papaya Global

Papaya Global manages payroll, payments, and workforce management within a single cloud-based platform.

Its solutions are tailored to multinational companies managing complex global teams.

Key features:

✨ Dedicated workforce payments: Manage payment classifications accurately and control payment timing across over 130 currencies.

✨ Payments OS: Run payroll in up to 15 currencies while automating tax deductions, filings, and social security contributions. You can also set recurring payments to run automatically on your preferred schedule.

✨ Workforce wallet: Centralise global payment operations through a multi-currency wallet with real-time visibility into balances and transactions.

✨ Local payment routing: I-country banking networks process payments locally.

Pricing

Papaya Global offers multiple quote-based pricing plans based on the service you need and the number of employees.

9. Deel

Deel is a global payroll and HR platform that supports payroll across over 150 countries with automated compliance.

It offers solutions that streamline hiring, managing, and paying employees and contractors worldwide.

Key features:

✨ Centralised payroll dashboard: Manage payroll operations across more than 100 countries through a single system.

✨ Payroll management: Automatically handle gross-to-net calculations, tax and benefit deductions, and currency conversions.

✨ Global compliance tracking: Helps you stay up to date with local labour laws, tax changes, and filing requirements in over 130 countries.

✨ Flexible payment options: Offers more than 15 payment methods to pay employees in more than 140 currencies worldwide.

Pricing

EOR services start at $599 per month, while Global payroll services are available as an add-on and start at $29 per employee per month.

Why should you choose Native Teams as your enterprise payroll solution?

Native Teams brings together global EOR services, advanced payment tools, local employment solutions, tax management, and employee benefits, all in one place.

Here’s what we bring to the table:

- Global payments made simple: Pay employees in 90 currencies through one dashboard, using real-time exchange rates and local payment rails.

- Streamlined payroll operations: Manage global payroll efficiently and ensure on-time, compliant payments.

- Effortless global hiring: Hire, manage, and pay teams in over 85 countries without the need to establish local entities.

- Built-in compliance management: Stay aligned with local labour laws, social security requirements, and tax obligations across all regions.

- Transparent exchange rates: Access real-time currency rates and clear fee structures to simplify payroll calculations and wallet transfers.

- Scalable team management: Send bulk invitations, set up multi-currency payrolls, and onboard employees quickly and easily.

- Enhanced employee experience: Give team members a secure self-service portal to view payslips, track payments, and update personal information.

- Locally compliant employment practices: Ensure that contracts, benefits, and employment terms fully comply with local regulations.

Want to learn more?

Book a free demo today to see how you can start managing payments, benefits, and HR operations from a single platform.

FAQ:

1. How to run international payroll?

Running international payroll starts with choosing a platform that supports multi-country operations and multiple currencies.

The platform must ensure compliance with local labour laws, tax regulations, and benefits requirements for each country.

Also, you want a platform that automates calculations, payments, and reporting to:

- Streamline processes,

- Reduce errors, and

- Maintain timely, accurate payroll across your global workforce.

Native Teams ticks all the boxes, providing you a single platforma that handles payments, taxes, admin, benefits, entity management, and more under one roof.

2. What are global payroll services?

Global payroll services help businesses manage employee compensation across multiple countries.

They handle local compliance, tax calculations, benefits, and currency conversions to ensure accurate and timely payments.

These services streamline payroll processes, reduce administrative burden, and provide centralised reporting for a global workforce.

3. What is a global HRIS system?

A global HRIS (Human Resource Information System) is a centralised platform that manages HR processes for employees across multiple countries.

It handles employee data, payroll, benefits, compliance, and talent management while ensuring alignment with local regulations.

A global HRIS streamlines HR operations, provides real-time insights, and supports efficient workforce management worldwide.

Keep learning:

9 Best Global Payroll Providers To Choose

Top 9 Payroll Trends That You Should Know

Challenges in Global Payment Processing: Costs and Inefficiencies