What should I know about hiring in Italy?

Recent reforms to Italian law have made the country, already home to one of the Western world’s greatest economies, more appealing to startup companies. In addition, entrepreneurs are drawn to Italy largely because of its favourable business climate and vast, educated labour force.

The Italian legal system governing employment and labour is notoriously intricate. Both national law and CBAs negotiated by labour unions and employer groups govern this area. In addition, some employment regulations adopted at the EU level also apply in Italy.

Workers in Italy enjoy generous benefits and protections, making it difficult to comply with the law. The following summary can help you get started. Still, unless you work with an employer of record (EOR), you will probably need legal counsel to ensure you don’t break any regulations.

Why is Italy a good choice for finding remote employees?

Italy is a great place to find skilled, dedicated, and reasonably priced remote workers. The area has many highly trained individuals and a high quality of life, making it an ideal spot to find the right employee for your company.

In addition, the Italian labour force has a strong tradition of excellence across many fields. Italian labourers have a well-deserved reputation for their diligence and perseverance. The work ethic in Italy is strong, and it is reflected in the high quality of the products that companies here make.

For this reason, enterprises looking to set up shop or grow their operations here should seriously consider this nation as a location. Moreover, there are a variety of financial and other perks available to businesses that migrate here.

How can Native Teams help you hire in Italy?

To begin employing remote Italian workers, you will require either a legal entity in Italy or the services of a worldwide recruitment solutions provider. Collaboration with Native Teams is a strategy that can be useful in such scenarios. In addition, with our Employer of Record services, we can also help you with the recruitment of new workers, the administration of their pay, taxes, and benefits, and the overall compliance with Italian legislation.

Hire your first Italian employee with Native Teams.

Legal requirements for hiring in Italy

Employers must consider and adhere to several employment laws in Italy to ensure a fully compliant hiring process.

Legal framework

The Workers’ Statute, established in 1970, remains Italy’s primary labour law. In contract law, the principle of contractual autonomy is crucial. This means that, as stated in Article 1322 of the Italian Civil Code, parties in a contract can freely decide what it includes within legal boundaries.

They can even create contracts not covered by specific regulations as long as they serve legitimate interests protected by the law.

Types of employment contracts

There are primarily two kinds of employment agreements: indefinite contracts and fixed-term contracts.

The indefinite contract, also known as “contratto a tempo indeterminato,” is the most common type of employment contract in Italy. Due to its open-ended nature, it provides various benefits, such as increased job stability and entitlements like severance pay.

On the other hand, a fixed-term contract, also known as “contratto a tempo determinato,” has a set end date. It’s often used for temporary work arrangements, offering flexibility for short projects or seasonal employment.

Content of an employment contract

According to Italian regulations, an employment agreement should include various details. These include identifying information about the involved parties, such as names, addresses, and tax codes.

Additionally, it should specify the workplace location and the start date of the employment. If the contract is of a fixed-term nature, its duration must be clearly stated. Any probationary period, if applicable, should also be outlined. Furthermore, the contract should define the employee’s grade, level, and qualifications as per the collective agreement.

Download a free employment contract for Italy through Native Teams.

Oral, written or electronic employment contracts

The employment contract should be in a written form, yet it can also be established verbally through actions that clearly indicate the beginning of job responsibilities. That said, it’s not obligatory for the employment contract to be in written form. Nonetheless, the absence of a written agreement doesn’t invalidate the employment arrangement outright.

Probationary period

The maximum duration of the probationary period extends to six months for all employees and three months for employees without managerial responsibilities.

Working hours

In Italy, the regular full-time work week typically comprises 40 hours. However, Collective Labour agreements can establish a shorter duration for contractual purposes, aligning normal working hours with the average work performance over a period not exceeding one year. Part-time contracts (contratto part-time) apply to roles requiring less than 30 hours per week.

Night work

According to the law, night work is defined as a period lasting at least seven consecutive hours, which includes the interval between midnight and 5 am.

Breaks and types of leaves

The regular full-time work week consists of 40 hours, and if the daily working period exceeds six hours, employees have the right to a break, the details of which are outlined in collective labour agreements.

Annual leave

The minimum holiday entitlement is four weeks. Collective agreements typically dictate the duration of holiday days, typically amounting to 22 days for those working five days a week and 26 days for those working six days. Annual leave days are accrued monthly, starting from the first month of employment.

Public holidays

Italy has 12 public holidays, which are officially designated as non-working days. Some of these include New Year’s Eve day, Epiphany, Easter Sunday, Easter Monday, and Liberation Day.

Salary

This compensation must not fall below a minimum threshold established by national collective agreements for each job category, taking into account qualifications.

The hourly, daily, and monthly wages for trade workers vary depending on the type of employment contract (full-time, part-time, apprenticeship) and levels of seniority.

The current minimum salaries are:

- Quadro: € 2.926,15

- Primo livello (Level 1): € 2.452,45

- Secondo livello (Level 2): € 2.189,30

- Terzo livello (Level 3): € 1.944,65

- Quarto livello (Level 4): € 1.750,00

- Quinto livello (Level 5): € 1.630,35

- Sesto livello (Level 6): € 1.514,65

- Settimo livello (Level 7): € 1.375,00

- For Dirigente position, the current minimum yearly salary is 58.660€.

To calculate the salary and taxes in Italy, click here.

Sick leave

Italy’s legal sick pay system offers assistance for a maximum of 180 days per calendar year under the nation’s social security framework.

Parental leave

Either parent can request parental leave until their child reaches 12 years of age or 12 years after adoption, provided they have a job, regardless of whether it’s full-time or part-time, and live with their child. The parental leave allowance is 30% of one’s wages, which is notably lower than the maternity leave allowance.

However, parental leave extends the period covered by INPS (Istituto Nazionale della Previdenza Sociale) by 30%, from 6 to 9 months, without changing the maximum duration of leave available to parents (up to 3 months, non-transferable, for each parent, totalling 6 months).

Paternity and maternity leave

Maternity leave involves a compulsory break from work for expectant mothers, lasting a total of five months, as stipulated by the Testo Unico on maternity. The woman is required to cease work two months before the anticipated delivery date and continue abstaining from work for up to three months after childbirth. Alternatively, if her health permits, she may begin her mandatory break one month prior to birth and extend it up to four months after delivery.

Furthermore, the Budget Law for 2019 introduced the possibility of taking mandatory maternity leave exclusively after childbirth, within five months following delivery, contingent upon certification by a specialist doctor of the National Health Service confirming the compatibility between the woman’s health condition and this arrangement.

On the other hand, employed fathers are entitled to a period of paternity leave lasting 10 working days, which can be taken from two months before the expected birth date up to five months after the child’s birth.

Methods of employment termination

The ways to end an employment contract include situations such as supervening impossibility and force majeure, individual dismissal, collective dismissal, the end of a sick leave period, incapacity to meet job requirements, the death of the employee, meeting conditions for old age pension, mutual agreement, and the expiration of a fixed-term contract.

Ordinary dismissal by employer

In fixed-term employment, ending employment is only allowed if there’s a good reason. However, for permanent jobs, there are rules to follow. Employers need a demonstrable just cause (akin to fixed-term contract terminations), valid subjective rationale, or legitimate objective grounds.

Notice period and challenging the dismissal

The notice period for indefinite contracts is influenced by factors such as seniority and qualifications.

For example, employees in full-time employment who have worked for up to 5 years are typically required to provide 8 calendar days’ notice. However, for those employed full-time for over 5 years, the notice period increases to 15 calendar days. Similarly, part-time employees who have worked for up to 2 years are typically required to provide 4 calendar days’ notice. If the individual has been employed part-time for over 2 years, the notice period increases to 8 calendar days.

In the case of fixed-term contracts, there are usually no provisions for early termination or a notice period, except in cases of mutual agreement or termination for just cause.

Rights and obligations of unemployed individuals

NASpI (The New Social Insurance for Employment) is available for unemployed individuals who have paid into it for at least 13 weeks in the four years before losing their job and worked for 30 days in the year before losing their job. Also, to get this benefit, they have to show that they’re actively looking for a new job.

Severance pay

Severance pay is calculated by setting aside a portion for each year worked, with the maximum amount capped at the yearly salary divided by 13.5. This method prevents the severance payout from surpassing the annual salary.

Moreover, the calculation accounts for partial years of service, with fractions of a year equal to or exceeding 15 days being counted as a full month.

Prohibition of competition

Upon hiring or subsequently, the employer may request the employee’s signature on a non-competition agreement. This prohibits the employee from engaging in competitive activities during and after employment termination.

Both parties are legally obligated by this agreement and can’t withdraw without mutual consent, ensuring the enforceability of the commitment over time.

Remote working policy

When employees carry out their responsibilities remotely, the regulations that apply differ depending on the type of remote work involved.

To implement either smart working or teleworking arrangements, both the employer and the employee must agree to specific terms through an individual agreement, detailing how the employee will work outside the company’s premises.

Smart working and teleworking

In smart working, employees focus on meeting goals rather than following set work hours, whereas in teleworking, employees must adhere to specific working hours set by the employer.

Under both regulations, employers are required to supply essential work tools unless agreed otherwise with employees. However, in teleworking, employers must reimburse or provide a flat-rate allowance for expenses related to teleworking, such as internet and phone bills, which is not necessary in smart working arrangements.

Health and safety at home

The teleworking guidelines enforce stricter health and safety (H&S) requirements compared to those for smart working.

Under smart working, employers must notify employees about the risks related to remote work. However, under teleworking regulations, employers are required to inform and train employees specifically about the risks associated with working on computer terminals.

What are the advantages of hiring employees from Italy vs other countries?

Hiring employees from Italy can be advantageous for several reasons. Firstly, Italy boasts a rich cultural heritage encompassing art, design, and cuisine. This diversity can inject fresh perspectives and creativity into your team.

Moreover, Italian language skills can be a valuable asset. With Italian being the official language of the European Union and spoken by millions worldwide, having employees proficient in Italian can facilitate communication in international markets.

Italy’s reputation for innovation is another key advantage. The country excels in industries such as automotive, fashion, and furniture design, making Italian employees valuable assets, particularly in roles requiring design or engineering expertise.

Why use Native Teams for hiring in Italy?

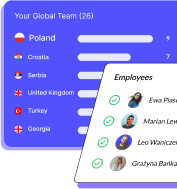

Native Teams lets you employ team members ‘like a local’ meaning you get all the benefits of a global team, wherever you are based. Here are the reasons why you should use Native Teams for hiring:

- No paperwork: We will handle all the necessary paperwork for you.

- Save on taxes: We help you handle your taxes.

- No company set up: You can expand your business using our company entitles.

- Online onboarding: We’re here to ensure your onboarding process is trouble-free.

- No accounting: We will handle all of your accounting needs, including invoicing, payroll, and more.

- Increase your profit: We assist you in growing your business and maximizing your profits.

- Compliance expertise: we can assist your company in navigating the regulatory environments and ensure you meet all relevant requirements.

- Local support: We can assist you in understanding and complying with the relevant local laws.